Why are your Medical Billing Claims Denied? – How can we help?

Do you often question yourself?

What percentage of your claims are denied yearly? How do you cater to the revenue losses? Are you too always looking for improvements that can minimize claim denials, boosting up your RCM process and reducing AR days?

In an analysis conducted in 2019 by CMS 18% of in-network claims were denied by issuers, with denial rates for specific issuers varying significantly around this average, from less than 1% to more than 40%. It was also found that appeal for denied claims is rarely made, and when it is, issuers typically uphold their original decision. MGMA states 25% of all claims not paid are never followed up on. This problematic picture results in heavy revenue plunges and thus negatively impacts the RCM process.

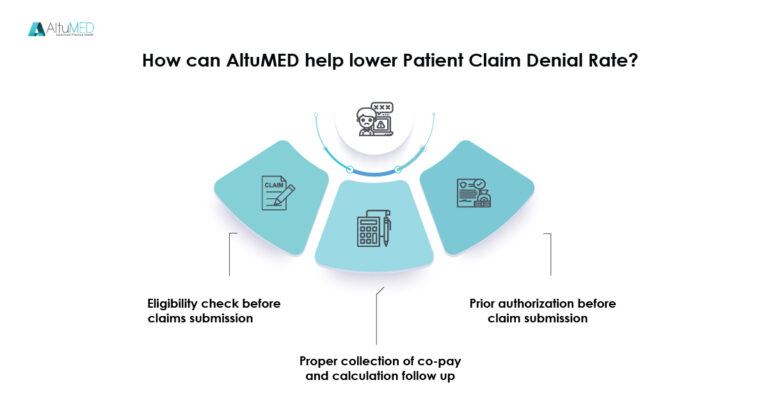

Practices are often dedicated to minimizing lost reimbursements and denials. AltuMED ensures as well as validates the insurance eligibility details of a patient from the time, they request your service. Our employees verify patient insurance details as well as pre-validate whether the required treatment will be covered by their insurance or not. More so AltuMED software comes with pre-fed ICDs and CTPs assisting physicians fast and error free data entry regarding the diagnosis as well as the procedures performed.

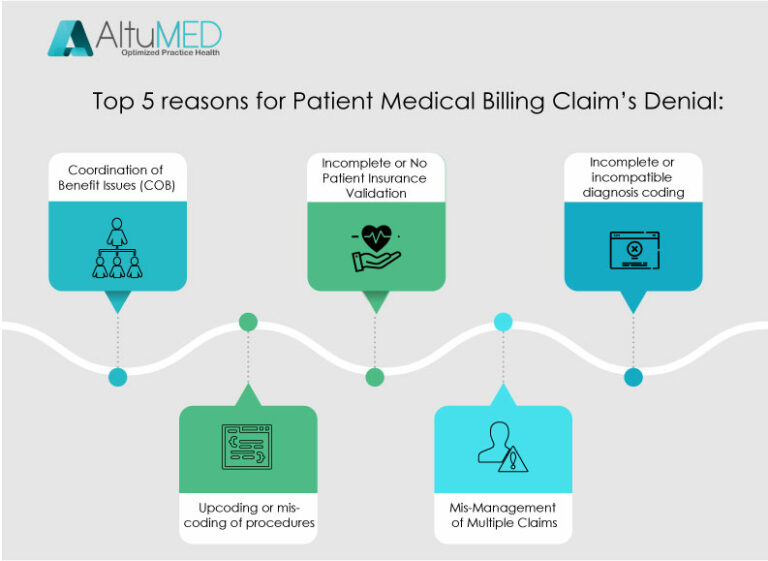

5 steps to lower your Patient Claims Denial Rate

Know your current denial rate. To calculate your current denial rate, add the total dollar amount of claims denied by payers within a given period, and divide that amount by the total dollar amount of claims submitted within the given period. For example, look at a three-month period. If your total dollar amount of claims denied within this period is $10,000—and your total dollar amount of claims submitted is $100,000—then your denial rate is 10%. Calculate your denial rate according to payer, reason for denial, provider, specialty, and location (if your practice includes more than one location).

Identify the major reasons for your denials. These reasons will vary by specialty and by practice. Start by compiling your claim adjustment reason codes. Though these codes may be somewhat cryptic as well as inconsistent across payers, they at least provide a foundation on which you can build a denial management strategy. Map these codes to more actionable descriptors so you can dig into your data at a more granular level and identify the root cause of the problem.

For example, consider categorizing denials according to these common reasons:

- Claim not submitted within timely filing guidelines·

- Demographic errors (e.g., wrong spelling of the patient’s name or wrong date of birth)·

- Duplicate claim·

- Eligibility expired·

- Global charges were billed when only the professional or technical component should have been billed·

- Incorrect insurer address·

- Incorrect modifier·

- Invalid procedure and/or diagnosis code·

- Lack of medical necessity·

- No referral/authorization·

- No supporting documentation·

- Payer requires additional information from the patient·

- Provider not permitted to see the patient under the plan·

- Service not covered·

- Wrong insurer billed

Hire a revenue cycle manager or certified medical coder. This individual can help track denials and improve your chances of submitting error-free claims. More specifically, he or she can:·

- Serve as a resource to clarify code combinations, definitions of modifiers, documentation requirements, and more·

- Validate codes that the physician chooses in the EHR·

- Note discrepancies between procedures documented and supplies ordered but not billed·

- Find missed charges based on progress note documentation.

Create a multi-disciplinary denial team. Be sure to include the practice manager, a representative from registration, a coder and/or biller, and at least one physician who is willing to serve as a champion of the denial management effort. Team goals should include the following:·

- Collect data regarding denials. How are denials identified? Verify your ability to extract this data from your practice management system, or secure a bolt-on denial reporting product.

- Review data to identify trends. Can the practice use automation to route denied claims directly to specific work lists? For example, route all coding-related denials directly to the coder·

- Create a standardized workflow for denials. This should include a step-by-step action plan for each type of denial. Who will handle each type of denial, and how?

Focus on staff education. Many practices benefit from staff education on the following topics:·

- Accurate data entry. Collecting accurate and complete demographic and insurance information on the front-end is critical. One of the most common denials occurs when a patient’s health insurance expires and either the patient or the practice (or both) are unaware. In other cases, practices may check eligibility when an appointment is made, but coverage is dropped before the actual visit occurs. Real-time eligibility tools that provide information about coverage, deductibles, copayments, and contractual fees for specific services and procedures are helpful.

- Policies and procedures for insurance coverage and eligibility (e.g., payer-specific requirements regarding appropriate ICD-10 codes to use with certain CPT/HCPCS codes). Consider designating one person to receive and review all newsletters and updates from payers. This person can then disseminate important information to the rest of the team.

- Documentation requirements for ICD-10 specificity. Depending on your specialty, ICD-10 codes may require more specific documentation regarding laterality, anatomical location, and more.

- Frequency/global rules for specific procedures. This should include a discussion of modifier usage.

- Advanced Beneficiary Notices. Education should include how to fill out forms properly and what patients need to know at the time of service.

Understanding your denials helps shed light on specific areas for improvement. By identifying these areas, your practice can take proactive steps to improve processes and mitigate risk going forward.

If you are looking for ways to improve you Patient Claim Denial Rate, contact AltuMED – The Revenue Cycle Management Specialist.

Subscribe to Our Newsletter!

Subscribe to Our Newsletter!

Enter Your Email Address. We Promise We Won't Spam You